Too Many Projects, Not Enough Capital

Part 1

The days when financially strong hospitals or health care systems could afford to fund every “good” project that came along are now officially over. Historically, stronger, credit‐worthy, non‐profit health care organizations were able to fund virtually all projects that could demonstrate an adequate return on investment (ROI). Today, however, even the strongest hospitals and systems are facing a “financial gap” – or a gap between sources of funds and potential uses of funds. Recently, for example, a large, multi‐state, Catholic health care system that holds an AA‐ bond rating concluded that it could afford to fund only 60 percent of the projects that its hospitals had identified as needed over the next seven years.

This new financial reality requires a new discipline be exercised at the Board level. The foundation of this discipline is the active use of a Strategic Financial Plan that integrates the organization’s strategic plan, long range financial plan, and capital plan.

As in any plan, the Strategic Financial Plan is built not only upon key assumptions but also reflects the preferences of the organization as it carries out its Mission and Vision in a financially prudent manner. The assumptions are usually developed by Management, with input from the Board and/or the Finance Committee regarding their reasonableness. The Board should request that Management conduct sensitivity analyses – or “what if” scenarios – to ensure that members of governance understand the impact should an assumption fail to materialize. The organizational preferences, on the other hand, should be jointly developed by the Board and Management. These preferences are often policy decisions that are the purview of the Board. For example, it is the Board’s responsibility to determine how much risk the organization should be willing to take either in expanding the amount of debt or in using riskier forms of debt.

Sources of Funds

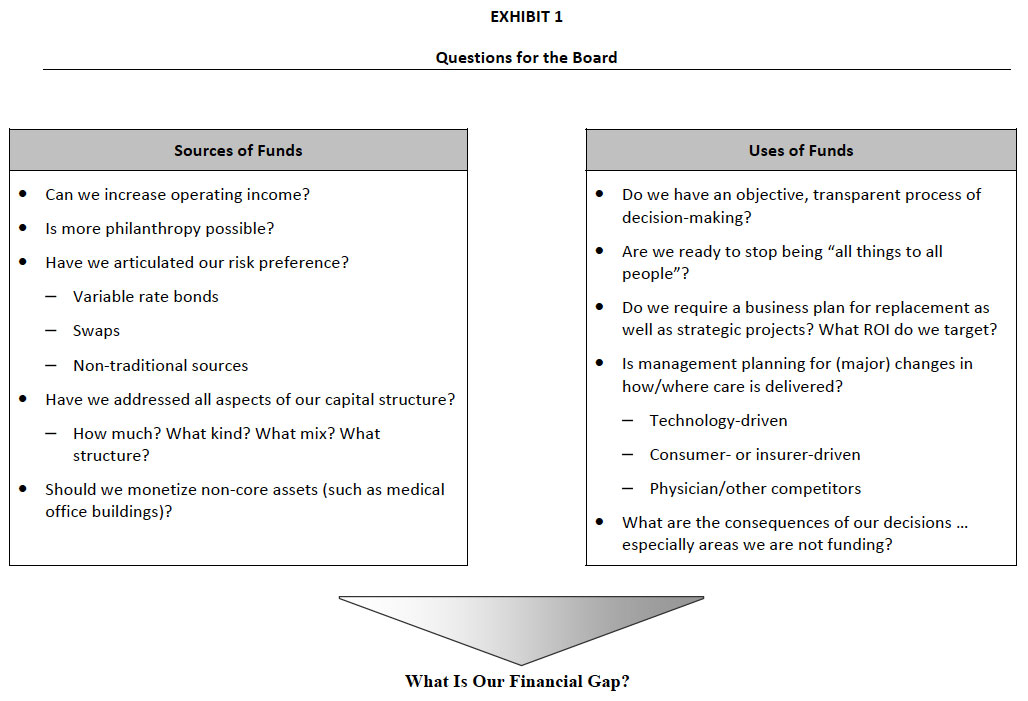

As outlined in Exhibit 1, the Board should be actively engaged in discussing how to increase sources of funds while maintaining the financial integrity of the organization. The Board should consider issues related to:

- Increasing Operating Income – The Board should establish an operating income (before any investment income) target, preferably over four percent. If the hospital or system is currently operating below that level, Board members must ensure that Management is

undertaking every effort to achieve minimally acceptable operating performance. The Board’s accepting inadequate operating performance is essentially allowing the organization to be self‐liquidating – an unacceptable position. - Charitable Giving/Philanthropy – The Board should set aggressive targets for charitable giving/philanthropy, starting with itself. Many successful hospitals and systems expect all members of the Board to provide philanthropic support, as much for the signal that it sends to the organization as for the total dollars raised. In addition, the Board should identify ways to increase giving from internal constituencies, including the medical staff and employees, as well as from former patients, community members, and corporations. The latter are often a long‐term proposition but it is never too late to start.

- Capital Structure – Tax exempt debt has been, and is likely to continue to be, a primary source of external financing for non‐profit hospitals and systems. However, according to the Health Care Financial Management Association, nearly half of hospitals’ external financing now comes from sources other than tax exempt bonds1, providing an ever‐expanding array of options for Boards to consider.

While the financing options have become substantially more complex over the past decade, the three goals for an effective capital structure have remained the same. They are:

- To minimize the cost of capital;

- To maintain financial flexibility; and

- To achieve an acceptable level of risk.

The myriad of new financing sources available to not‐for‐profit hospitals and systems require that Board members clearly articulate their preference related to:

- How much debt can the hospital or system afford to take on?, and

- What kind of debt should the hospital or system use?

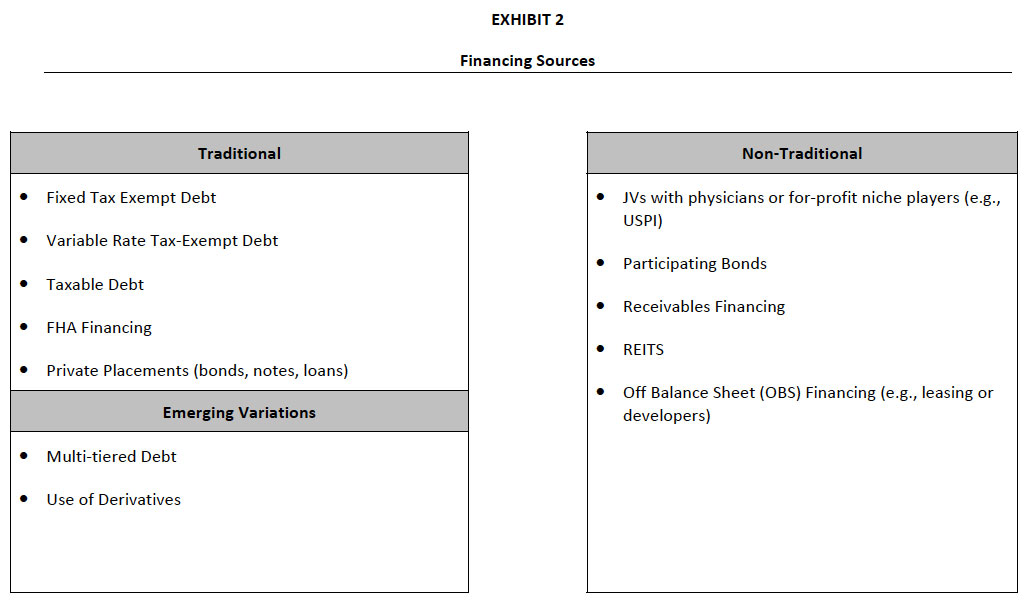

As indicated in Exhibit 2, the variety of available financing sources includes traditional debt, emerging variations such as multi‐tiered debt and derivatives, and non‐traditional financing sources, including leasing, joint ventures, or engaging developers.

The issues associated with moving away from the more traditional financing sources are extremely technical and often beyond the experience of Board members and even Chief Financial Officers. Typically, hospitals will engage an experienced financial advisor and/or investment banker to help sort out the advantages and disadvantages of each option. However, none of the experts can answer a fundamental question facing the Board: that is, “What is our attitude toward risk?”

There has been considerable interest in so‐called “Off Balance Sheet” (or OBS) financing over the past several years, typically in the form of leasing or using a developer for a project. While this may seem attractive, these transactions create a long‐term liability on the part of the organization and, therefore, are akin to debt. The true cost of these financing options is generally higher than more traditional debt. Increasingly, the bond rating agencies view such OBS financing as similar, if not identical, to more traditional forms of debt financing in determining the hospital or system’s rating.

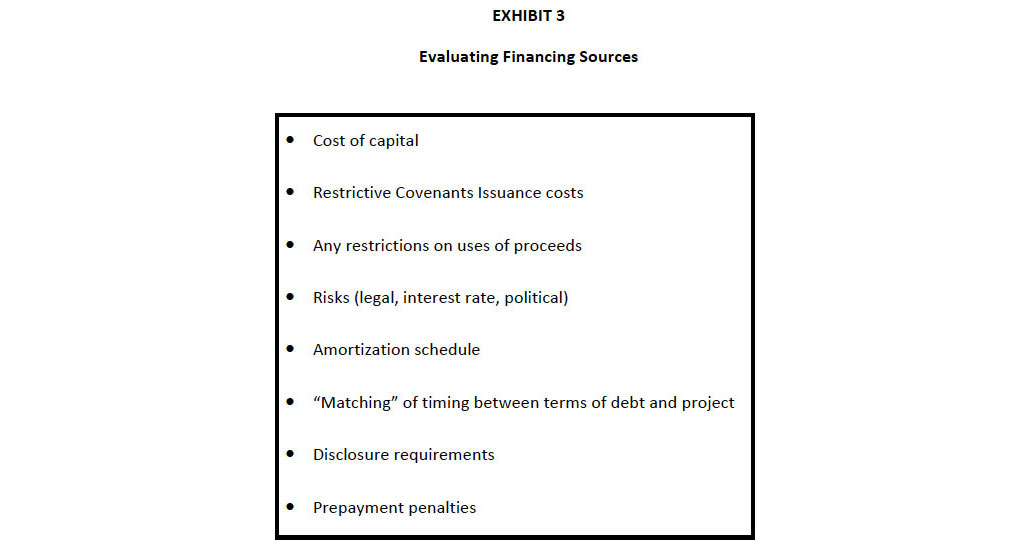

Exhibit 3 outlines what the Board should include in its evaluation of any financing option. While many of these tasks will be undertaken by Management, the Board, especially through its Finance Committee, should understand and be comfortable with the approach and the associated risks that the hospital/system is taking.

- Monetizing Non‐Core Assets – Many hospitals have or are considering converting non‐core assets, such as medical office buildings or a parking facility, into cash that can then be used for upcoming capital projects. However, Board members must understand that these

transactions are not always as simple as they appear. Often, in order to sell off the non‐core asset, the hospital must enter into a long‐term operating lease with the purchaser. This, of course, creates a long‐term liability in the form of Off Balance Sheet financing. However, in certain circumstances, there is true economic value to the hospital or system in pursuing this course.

By addressing all the questions related to increasing Sources of Funds, the Board has answered half of the question posed in Exhibit 1, “What is our financial gap?”. That is, the Board has and can determine the magnitude of capital available to support future capital projects.

To develop a complete Strategic Financial Plan, the hospital or system must then articulate its capital needs over the period, including replacement capital, capital for strategic investments, and funding required to achieve a targeted level of days‐cash‐on‐hand (to support a targeted bond rating). Part 2 of this article will explore the issues that the Board must address in order to prudently determine which projects to fund and how much cash/investments to hold in reserve.

The Governance Institute E-Briefing – January 2007

Marian C. Jennings, President – M. Jennings Consulting, Inc.

› Download PDF

This article is part one of a two part series. This article focuses on identifying ways to increase sources of funding for capital projects. The second article will focus on allocating capital to the most worthy projects.