Financing Options for Small or Rural Hospitals

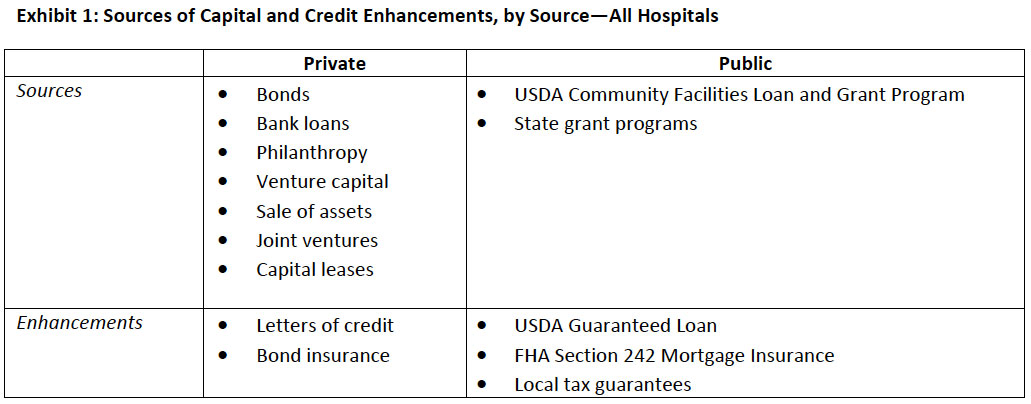

This article is Part 2 of a two‐part series highlighting the capital financing options available to small or rural hospitals, including the risks associated with the most common approaches. Part 1 (August 2008) focused on private financing sources and credit enhancements available to small or rural hospitals. Part 2 focuses on public financing options and the role of the board in evaluating financing options.

There are more than 1,650 small or rural hospitals in the United States, including nearly 1,300 critical access hospitals (CAHs).1 These hospitals serve about one‐fifth of the U.S. population, and tend to care for more elderly and frail patients than do urban hospitals.2 Because of their small size, modest assets and financial reserves, these small hospitals face significant challenges in securing financing to meet their ongoing capital needs.

Public Sources of Capital

1. US Department of Agriculture (USDA) Rural Development Community Facilities Loan and Grant Program

The USDA Rural Development Community Facilities Program offers facility development funds to non‐profit, rural organizations that provide certain public services to communities with populations of less than 20,000 people. Eligible facilities include “schools, libraries, childcare, hospitals, medical clinics, assisted living facilities, fire and rescue stations, police stations, community centers, public buildings, and transportation.”3 Reporting to date indicates that Community Programs has invested $1.2 billion in rural communities, a third of which has been invested in rural healthcare.4

Two types of funding are available: direct loans and grants. (The USDA also offers guaranteed loans, which will be discussed under credit enhancements below.)

Key features of USDA Rural Development Community Programs Direct Loans:

- May be used to construct, enlarge, or improve health care facilities.

- No “maximum” loan amount.

- Loan amount may include costs to acquire land, pay professional fees, and purchase equipment for operations.

- Three levels of fixed interest rates are available, based on median household income for the area being served by the project: poverty (4.5 percent), intermediate, and market.

Key features of USDA Rural Development Community Programs Grants:

- Similar to Direct Loans in terms of use.

- Typically used to “fund projects under special initiatives.”5

- Priority assigned to projects that serve smaller communities (under 5,000 population), that serve low‐income communities (median household income levels below poverty line), and/or that provide healthcare, public safety, or public and community services.

- Grant assistance available for up to 75 percent of total project cost, but no set maximum amount.

2. State Grant Programs

Several states offer grants to support development of rural healthcare facilities. Typically, grant amounts are small and awards may be restricted to special initiatives or populations.

Example: Minnesota Rural Hospital Capital Improvement Grant Program

- Rural hospitals may apply for grants up to $125,000 to improve facilities

- $1.8 million available in FY 2008

Source: Minnesota Department of Health, at www.health.state.mn.us/divs/orhpc/funding.

Public Credit Enhancements

Credit enhancements can offer small and/or rural hospitals lower cost access to capital by lowering the interest rates applied to bonds or loans associated with the debt. Credit enhancements may be private or public. The three most common types of public enhancements are USDA Rural Development Community Facilities Guaranteed Loans, HUD/FHA Mortgage Insurance, and local tax guarantees.

USDA Rural Development Community Facilities Guaranteed Loan Program6

- Rural Development (RD) may guarantee up to 90 percent of loss of principal and interest on loans and bonds made to develop or improve essential community facilities in rural areas, including healthcare facilities.

- Populations in eligible communities must not exceed 20,000 persons.

- The guaranteed portion is backed by the “full faith and credit” of the U.S. government and may be sold on the secondary market.

- The maximum term is 40 years. The interest rate may be fixed or variable, and is negotiated between the borrower and lender.

HUD 242/Federal Housing Administration Section 242 Loan Guarantees

- Used for acute‐care hospital projects, typically of significant size and scope, including new construction, modernization, remodeling, equipment, and expansion.

- Not limited to rural hospitals, FHA Guarantees had traditionally been used for larger, urban facilities, until rural hospitals in Colorado and Idaho received financing in 2003.7

- Up to 90 percent total project costs are eligible for guarantee; 99 percent of the guarantee amount is insured by the FHA.

- Recipients must demonstrate financial stability and ability to repay the debt: over the last three fiscal years, operating margin must have been positive and the average debt service coverage ratio must have been greater than or equal to 1.25.

- The maximum term is 25 years; one‐time fee of 0.8 percent and fixed annual premium of 0.5 percent of the remaining loan balance.

Local Tax Guarantees

In some cases, tax revenues may be used to improve credit profiles or to increase debt capacity associated with bond issuance. Of course, the hospital must obtain local government and/or voter approval for tax guarantees—a political process that can be costly, time‐consuming, and highly risky.

Role of the Board in Evaluating Financing Options

No matter what financing options are being considered, the board should consider several factors, and make an informed choice including an understanding of the inherent risks of its choice. Factors include:

- Total cost of capital

- Restrictive covenants

- Issuance costs

- Restrictions on uses of proceeds

- Risks (legal, interest rate, political, etc.)

- Amortization schedule

- “Matching” of timing between terms of debt and project initiation/completion

- Disclosure requirements

- Prepayment penalties

Conclusion

This series has highlighted the more common financing vehicles available to independent small and rural hospitals. Regardless of the option selected, strengthening the underlying financial viability of the hospital (generating a positive operating margin and using debt conservatively), especially when anticipating the need for capital financing, is the single most important step that the hospital can take.

Recommended Reading

- Financing the Future Report 1: How Are Hospitals Financing the Future? Access to Capital in Health Care Today. Healthcare Financial Management Association, 2003.

- “Financing Options for Nonprofit Rural and Community Hospitals.” Lancaster Pollard White Paper, October

2005.

The Governance Institute thanks Marian C. Jennings, M.B.A., president, and Amy B. Hughes, M.H.A., vice president, M. Jennings Consulting, Inc., for contributing this article. Ms. Jennings can be reached at mjennings@mjenningsconsulting.com, and Ms. Hughes can be reached at ahughes@mjenningsconsulting.com.

The Governance Institute BoardRoom Press – October 2008

Marian C. Jennings, M.B.A., President, M. Jennings Consulting, Inc.

Amy B. Hughes, M.H.A., Vice President, M. Jennings Consulting, Inc.

› Download PDF

2 American Hospital Association Rural Health Care 2007 Annual Report.

3 USDA Rural Development Web page, www.rurdev.usda.gov/rhs/cf/cp.htm.

4 USDA Rural Development Web page, www.rurdev.usda.gov/rhs/cf/essent_facil.htm.

5 USDA Rural Development Grants Web page: www.rurdev.usda.gov/rhs/cf/essent_facil.htm. Special initiatives include Native

American community development efforts; child care centers linked with the federal government’s Welfare‐to‐Work initiative;

federally‐designated Enterprise and Champion Communities, and the Northwest Economic Adjustment Initiative area.

6 USDA Rural Development Community Facilities Guaranteed Loan Program Web page: www.rurdev.usda.gov/

rhs/cf/CFG/CFG_Overview.html.

7 Julie Piotrowski, “An FHA First: Rural hospitals in Colorado, Idaho win Section 242 financing,” Modern Healthcare, May 26,

2003.