Too Many Projects, Not Enough Capital

Part 2

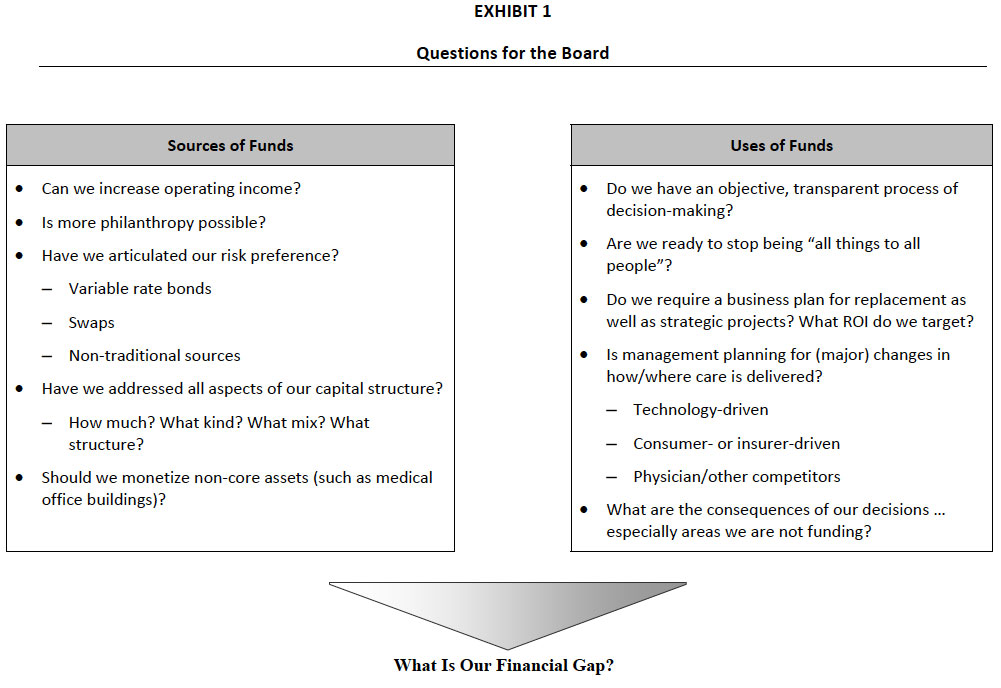

Once the Board has determined the magnitude of capital available from all sources to support future projects as outlined in Exhibit 1 (for more detail, refer to Part 1 of this article in the January 2007 e‐Briefings), it must address even more difficult issues related to determining which capital projects to fund and how much cash/investments to hold in reserve. A key to making the most reasonable, prudent decisions is to utilize a process that is as transparent, objective, and analytically based as possible. The foundation of the allocation process is a consensus that the hospital or health system does not, and will not, have sufficient capital to fund all requested projects. Therefore, allocation priorities must be made to best further the mission and vision of the organization and enhance its long‐term financial viability.

Uses of Funds

As outlined in Exhibit 1, the Board should be actively engaged in discussing how funds are allocated and, equally important, how much cash/investments the organization should hold in reserve. As outlined in a previous article1 on the importance of cash for long term financial strengths, a typical starting point in the process is to target the “days cash on hand” that the organization wishes to maintain or build toward. This critical financial ratio, an underpinning of any targeted bond rating, often imposes significant financial discipline on the organization. For example, a hospital that wishes to maintain at least an A+ bond rating might target cash/investments at or above 202 days, the median in 2006 for bonds holding such a rating. A targeted bond rating, and the associated cash funding requirement, should be an explicit part of the capital allocation process.

Beyond that, the Board should ensure:

Objective/Transparent Decision Making – The annual capital allocation process used by the Board should be part of a longer, multi‐year planning process. Most successful hospitals and health systems develop a strategic financial plan (typically for a five year time horizon) and utilize this plan as the basis for determining the amount of capital that is available to be invested each year and for the entire period.

In order to ensure an objective, transparent process, the Board should:

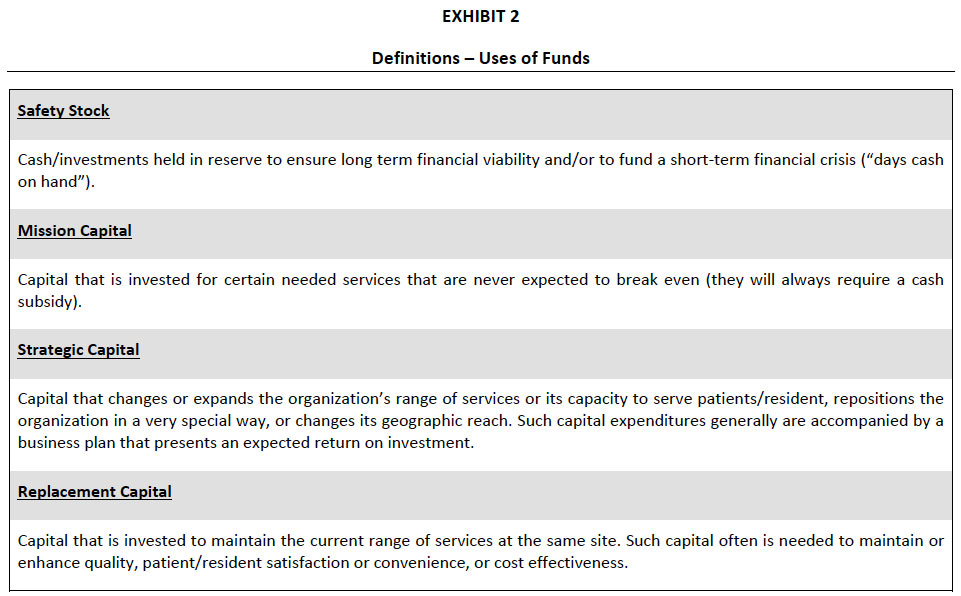

- Use a standard set of definitions related to uses of funds, such as the examples presented in Exhibit 2.

- Use a standard template for all capital requests to facilitate making comparisons among dissimilar projects.

- Utilize a consistent review process for all projects to create a level playing field. “End runs” by physician leaders and/or managers who advocate for a preferred project cannot be tolerated.

The Board should recognize that standardizing the capital allocation process – from project submission through analysis to decision making – is difficult and takes self‐discipline and considerable time and effort. The Finance Committee must be actively involved in this effort.

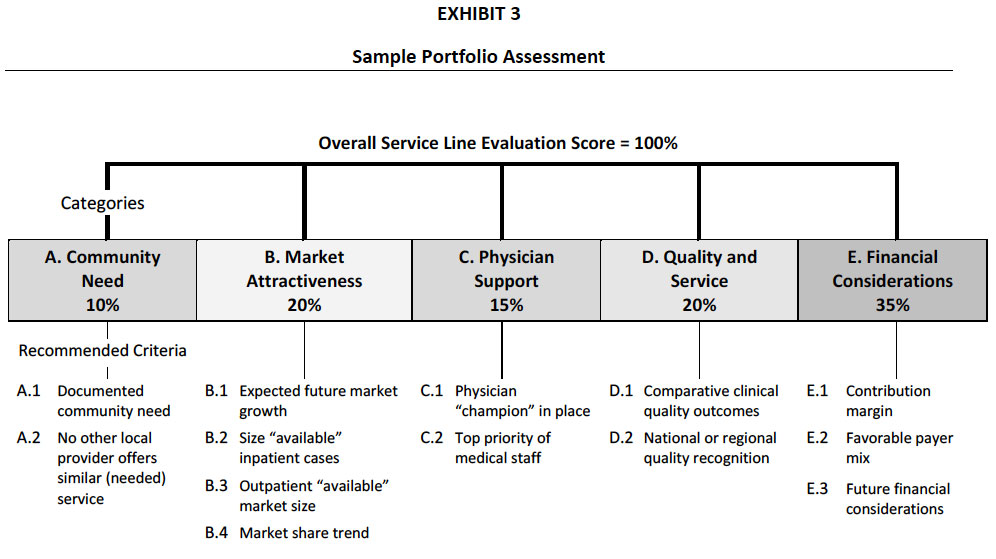

Use of Portfolio Assessment – Many hospitals and systems have adopted a “portfolio” approach to support capital allocation, recognizing that the organization cannot be “all things to all people.” While from a strictly financial perspective, the hospital would prefer to allocate capital to projects based solely upon expected return on investment (ROI), typically not‐for‐profit hospitals and systems use a more robust model for supporting informed capital allocation decisions. Such a model seeks to balance the charitable purpose/intent (mission) of the organization, strategic and business opportunities/risks, and financial return considerations.

Portfolio assessment can be applied to individual projects, for example an ambulatory surgery center versus renovating the inpatient operating suite versus investing in a clinical information system, or it can be used to evaluate and set priorities among service lines or business units.

Exhibit 3 presents a set of evaluation criteria used by a community hospital to evaluate each of its service lines in order to determine:

- Highest priorities for capital to support growth and development.

- Targets for improvement, without sizable capital investments.

- Targets for programmatic downsizing, closure or divestment to free up capital.

Portfolio assessment is a tool; it is never a substitute for management or Board judgment. However, it is a very powerful tool that communicates throughout the organization the priorities of the Board and senior management.

Business Plan Required for All Projects – One of the common shortfalls in hospital capital allocation is that large “replacement” projects – such as replacing beds with a new bed tower or renovating large portions of the hospital – are brought to the Board with no associated business plans. While these projects may seem unavoidable, it is imperative that the Board recognize that replacement capital competes for priority with strategic capital. The Board must avoid the trap of using up the organization’s entire financial capability on “replacing” facilities to the detriment of developing new programs/services or delivery sites to meet the needs of the future.

Commonly, large hospital renovation/replacement projects generate no incremental volume and, therefore, no tangible return on investment. It is essential that the Board recognize the requirements for higher rates of return on all other capital investments implied by approving large replacement projects with no returns.

Changes in Health Care Delivery – As mentioned above, in finalizing capital allocation decisions, the Board should always ask for management input related to how a particular project will meet expected future health care needs. Specifically, the Board should receive confirmation that the project is being designed with sufficient flexibility that it could accommodate:

- Technology driven changes, which may move today’s inpatient services into the ambulatory and/or home settings.

- Changes in consumer expectations, compounded by new insurance plans which require patients to pay more of their health care costs. Future consumers are likely to be more demanding in terms of access, convenience, and low‐cost options. The Board should know how a proposed capital project addresses these future consumer expectations.

- Competition from physician owned ventures down the road.

Consequences of Our Decisions – At the conclusion of each capital allocation cycle, it is valuable for the Board and senior management to clearly articulate the consequences of the proposed allocation, especially for those projects/programs which will not be funded as requested. Essential to making sound, informed decisions over time is recognizing the potential risks associated both with decisions to move forward and with decisions to postpone or deny capital requests. For projects that are in the “gray zone” – that is, projects that were deemed worthy, but for which funding was not available – the Board should consider asking senior management for “trigger points,” or changes in the internal or external environment, that would indicate that a re‐evaluation would be prudent.

The Board Finance Committee should shoulder most of the responsibility to ensure that sources of funds are maximized while maintaining a prudent level of risk, that the hospital or health system maintains a strong balance sheet including sufficient days cash on hand and capitalization ratios within a targeted range, and that the most worthy projects are funded. The Board should not duplicate the work of the Finance Committee but it needs to be fully informed about the philosophy underlying capital formation and allocation; basic principles associated with the process; the objective, consistent process used to evaluate projects and allocate capital; and the risks associated with both the preferred capital structure and capital allocation decisions. While some aspects of this process are highly technical, the general framework utilized, rationale for the preferred approach, and consequences of the process should be made understandable to each and every Board member.

The Governance Institute E-Briefing – March 2007

Marian C. Jennings, President – M. Jennings Consulting, Inc.

› Download PDF

This article is the second in a two‐part series. This article focuses on ensuring that capital allocation flows to the most worthy projects at the hospital or health care system.

1 Jennings, M.C. “Importance of Cash for Long‐Term Financial Strength.” Governance Institute, BoardRoom Press,

August 2005.